Case study: Finance

|

Introduction to R Bern R Bootcamp |

|

adapted from static.memrise.com

Overview

In this case study, you will analyse historic data of three major stock indices, the Dow Jones, the DAX, and the Nikkei, and the exchange rates between the US dollar, the Euro, and the Yen. Using this data, you will address several questions.

- How large was the impact of the recent financial crisis on the respective stock markets?

- How correlated is the development between the stock markets?

- What is the relationship between stock market returns and exchange rates?

To address these questions, you will import several data files, using various function parameters to match the idiosyncrasies of the data. You will merge the data files into a single data frame, and mutate the data to reflect changes in index price and exchange rate. You will analyze correlations of stock indices among themselves and to exchange rates and create illustrative plots for each of the analyses.

Below you will find several tasks that will guide you through these steps. For the most part these tasks require you to make use of what you have learned in the sessions Data, Wrangling, Analysing, and Plotting.

Tasks

A - Getting Setup

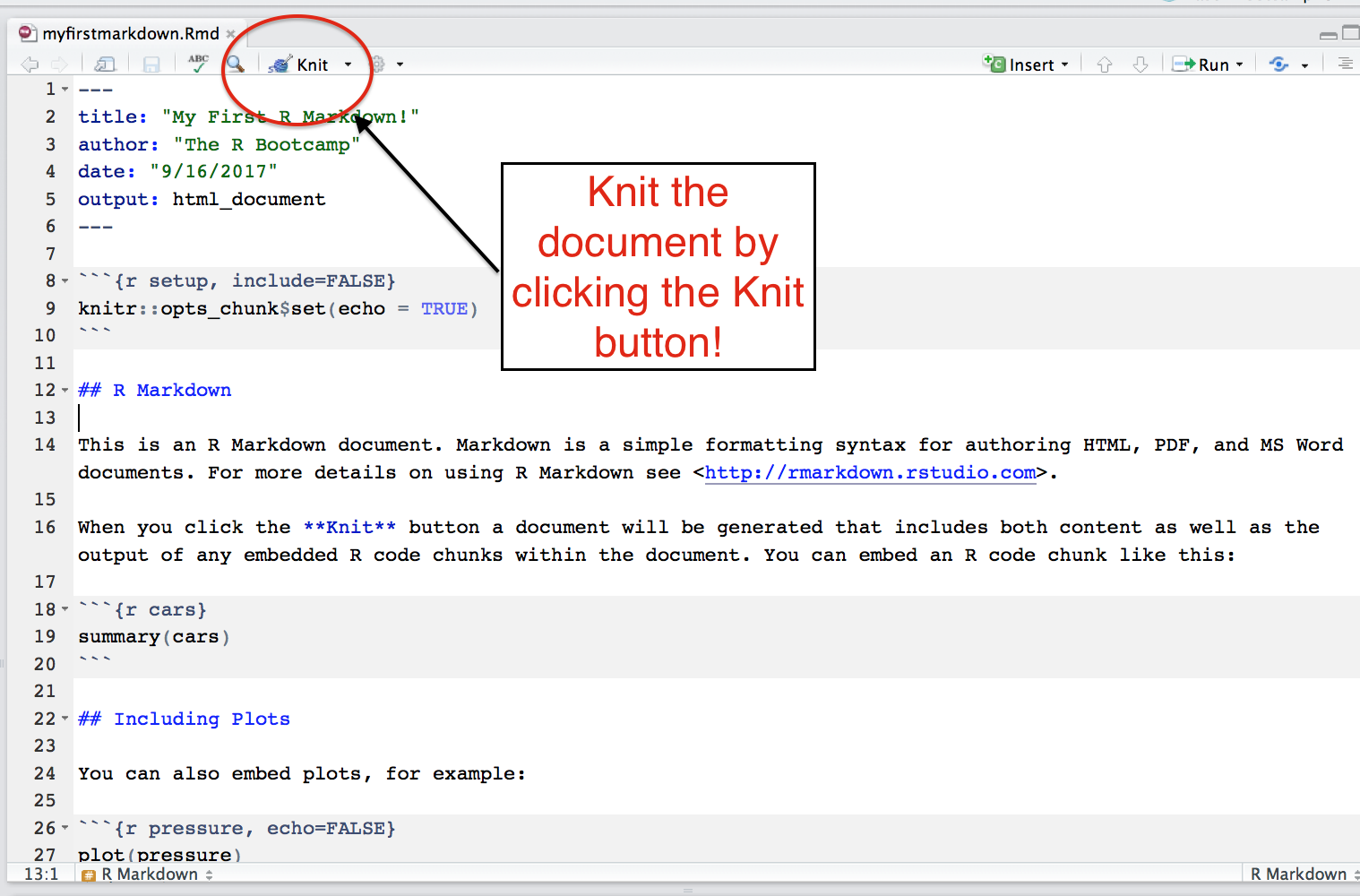

Open your

bernrbootcampR project. It should already have the folders1_Dataand2_Code.We want to generate an R Markdown document for this case study. In RStudio, click File – New File – R Markdown – Document – Html. Save your markdown file in your main project directory under the name

financial_casestudy.Rmd.At the top of the script load the

tidyversepackage.From time to time - don’t forget to

Knityour code with the Knit-Button.

B - Data

In this practical, you will load three external data sets

\^DJI.csv,\^GDAXI.csv, and\^N225.csv. However, two of these data files are not yet tidy. Specifically,\^GDAXI.csvand\^N225.csvinclude a specific character string to represent missings in the data and is not identify by R as such. To identify theNA-character string in the data open one of them in a text viewer, (via RStudio or via, e.g., textedit). Do you see the string value that indicates missing data?Once you have identified the character string for missing data, us the

read_csv()function to load in the stock index data sets, “^DJI.csv”, “^GDAXI.csv”, and “^N225.csv”, from your1_Datafolder. In so doing, set an explicitna-argument to account for the fact that “^GDAXI.csv” “^N225.csv” use a specific character string to represent missings in the data.

# Load index data from local data folder

dow <- read_csv(file = '1_Data/^DJI.csv')

dax <- read_csv(file = '1_Data/^GDAXI.csv', na = 'XXX') # 'XXX' means missing!

nik <- read_csv(file = '1_Data/^N225.csv', na = 'XXX') # 'XXX' means missing!# Load index data from local data folder

dow <- read_csv(file = '1_Data/^DJI.csv')

dax <- read_csv(file = '1_Data/^GDAXI.csv', na = 'null')

nik <- read_csv(file = '1_Data/^N225.csv', na = 'null')- Load in the exchange rate data sets,

euro-dollar.txtandyen-dollar.txt, from the1_Datafolder as two new objects calledeur_usdandyen_usd. To do this, use theread_delim()-function and\tas thedelim-argument, telling R that the data is tab-delimited.

# Load exchange rate data from local data folder

eur_usd <- read_delim(file = '1_Data/euro-dollar.txt', delim = '\t')

yen_usd <- read_delim(file = '1_Data/yen-dollar.txt', delim = '\t')- Print the

eur_usdandyen_usdobjects. Are all the data types and variable names correct? Not quite, right?

# print exchange rate data sets

eur_usd # A tibble: 6,545 x 2

`04 Jan 1999` `1.186669`

<chr> <dbl>

1 05 Jan 1999 1.18

2 06 Jan 1999 1.16

3 07 Jan 1999 1.17

4 08 Jan 1999 1.16

5 11 Jan 1999 1.15

6 12 Jan 1999 1.16

7 13 Jan 1999 1.17

8 14 Jan 1999 1.17

9 15 Jan 1999 1.16

10 18 Jan 1999 1.16

# … with 6,535 more rowsyen_usd# A tibble: 8,764 x 2

`02 Jan 1990` `0.006838`

<chr> <dbl>

1 03 Jan 1990 0.00686

2 04 Jan 1990 0.00698

3 05 Jan 1990 0.00695

4 08 Jan 1990 0.00694

5 09 Jan 1990 0.00689

6 10 Jan 1990 0.00688

7 11 Jan 1990 0.00688

8 12 Jan 1990 0.00688

9 16 Jan 1990 0.00687

10 17 Jan 1990 0.00687

# … with 8,754 more rows- To fix the data, first load the data again and use the

col_names-argument to explicitly assign the column names to beDateandRate. This will prevent R to take names from the first row of the data.

# load data specifying col_names

eur_usd <- read_delim(file = '1_Data/euro-dollar.txt',

delim = '\t',

col_names = c('Date', 'Rate'))

yen_usd <- read_delim(file = '1_Data/yen-dollar.txt',

delim = '\t',

col_names = c('Date', 'Rate'))- Now, change the variable

Dateto typedate. Fix this using theparse_date()function withformat = '%d %b %Y'. This specifies the exact format the dates are formatted in. Overwrite the existingDate-variable.

# change Date to date type in both datasets

eur_usd <- eur_usd %>%

mutate(Date = parse_date(Date, format = '%d %b %Y'))

yen_usd <- yen_usd %>%

mutate(Date = parse_date(Date, format = '%d %b %Y'))- Now you should have tidier data! Go ahead an explore the data a bit. What data do they contain? Consider using

summaryorskimr::skim().

C - Wrangling

- Before we can begin the analysis of the data, we need to join the individual data frames into a single data frame called

financial_datathat contains only the dates variable (Date), the stock index (unadjusted) closing prices (Close), as well as the exchange rates. Begin by joiningdowanddaxusinginner_join(), selecting only theDateandClosevariables of each data frame. See code below.

# create single data frame

financial <- dow %>%

select(Date,Close) %>%

inner_join(dax %>% select(Date, Close), by = 'Date')

financial# A tibble: 7,577 x 3

Date Close.x Close.y

<date> <dbl> <dbl>

1 1987-12-30 1950. 1005.

2 1987-12-31 1939. NA

3 1988-01-04 2015. 956.

4 1988-01-05 2032. 996.

5 1988-01-06 2038. 1006.

6 1988-01-07 2052. 1014.

7 1988-01-08 1911. 1027.

8 1988-01-11 1945. 988.

9 1988-01-12 1929. 987.

10 1988-01-13 1925. 966.

# … with 7,567 more rows- Inspect the data! What has R done with the names of the two

Closevariables? Run the code again, this time using thesuffix-argument to give both variables suffixes preserve the origin of these variables, e.g.,suffix = c(_dow','_dax').

# create single data frame

financial <- dow %>%

select(Date,Close) %>%

inner_join(dax %>% select(Date, Close),

by = 'Date',

suffix = c('_dow','_dax'))

financial# A tibble: 7,577 x 3

Date Close_dow Close_dax

<date> <dbl> <dbl>

1 1987-12-30 1950. 1005.

2 1987-12-31 1939. NA

3 1988-01-04 2015. 956.

4 1988-01-05 2032. 996.

5 1988-01-06 2038. 1006.

6 1988-01-07 2052. 1014.

7 1988-01-08 1911. 1027.

8 1988-01-11 1945. 988.

9 1988-01-12 1929. 987.

10 1988-01-13 1925. 966.

# … with 7,567 more rows- Looks better now? OK, now that you know how to join two data sets repeat the steps until all five data sets are included in

financial. Remember, we only want the dates variable (Date), the stock index (unadjusted) closing prices (Close). Note if you have trouble fixing all variables names using thesuffix-argument you can also take of this at the end usingrename().

financial <- financial %>%

inner_join(nik %>% select(Date, Close), by = 'Date') %>%

inner_join(eur_usd, by = 'Date') %>%

inner_join(yen_usd, by = 'Date', suffix = c('_eur', '_yen')) %>%

rename(Close_nik = Close)- Alright, now let’s create

changevariables that show how the exchange rates and stock indices have moved. Use themutate- and thediff()-function. Thediffcomputes the differences between every adjacent pair of entries in a vector. As this results in one fewer differences than there values in the vector add anNAat the first position of the change variable à lac(NA, diff(my_variable)).

# create variables representing day-to-day changes

financial <- financial %>%

mutate(

Close_dow_change = c(NA, diff(Close_dow)),

Close_dax_change = c(NA, diff(Close_dax)),

Close_nik_change = c(NA, diff(Close_nik)),

Rate_eur_change = c(NA, diff(Rate_eur)),

Rate_yen_change = c(NA, diff(Rate_yen))

)- We will be mainly interested in how stock prices and exchange rates change over the course of a year. To create a variable that codes the year

mutate()andlubridate::year(Date), which will extract fromDatethe year information.

# load lubridate

library(lubridate)# create year variable

financial <- financial %>%

mutate(year = year(Date))- Finally, we want the data in the “long”, instead of the current “wide” format. Call this dataset

financial_long. In long formats variables occupy different rows rather than columns. We want to end with 4 columns: Date, year, variable and value.

# create long version of data frame

financial_long <-

financial %>%

pivot_longer(names_to = 'variable',

values_to = 'value',

cols = c(-XXX,

-XXX))# create long version of data frame

financial_long <-

financial %>%

pivot_longer(names_to = 'variable',

values_to = 'value',

cols = c(-Date, -year))- Now your data is tidy proper (at least with regard to the analyses required here)! Go ahead an explore the data a bit. What data do they contain? Consider using

summaryorskimr::skim().

D - Analysing and Plotting

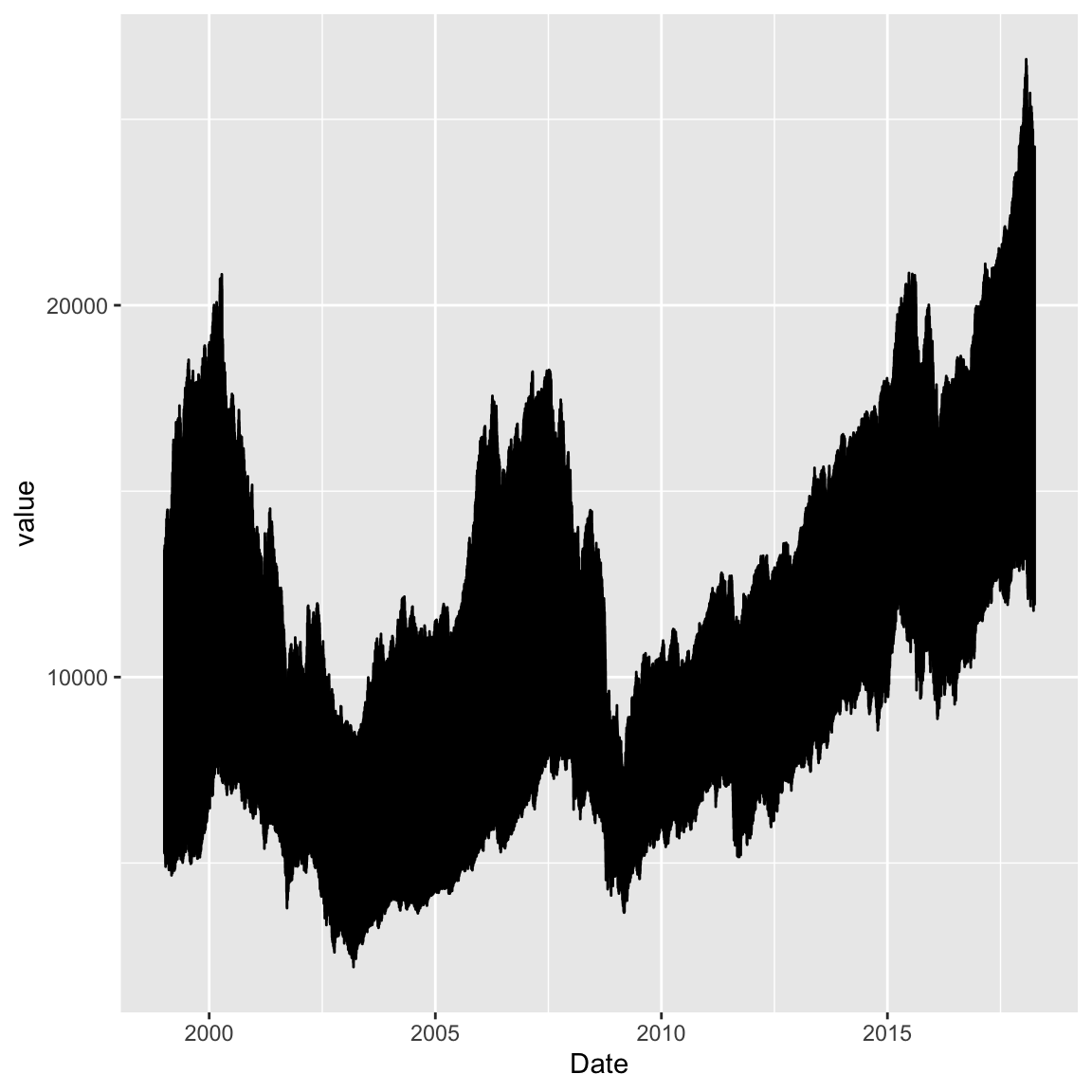

- Plot the development of each of the stock indices over the available time periods. First, select rows corresponding to the stock index prices. Then use the

ggplot()-function to start a plot. Then, MapDatetoxandvaluetoyin theaes()-function. And, finally, add ageom_line(). Does the plot look right?

# plot long version of data frame

financial_long %>%

filter(variable %in% c("Close_dow", "Close_dax", "Close_nik")) %>%

ggplot(mapping = aes(x = Date, y = value)) +

geom_line()

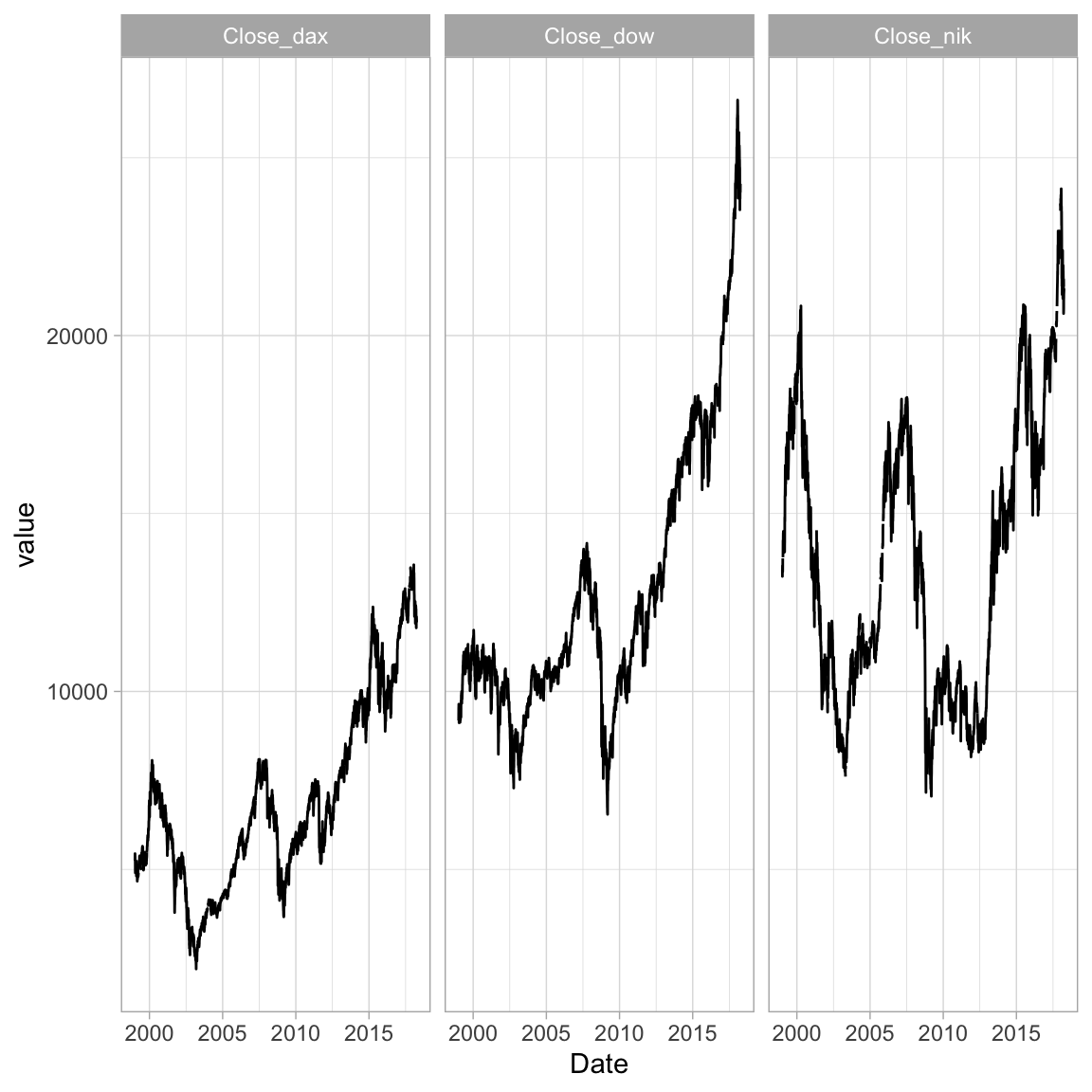

- Looked like the values of the three stock indices were somehow overlayering each other. Use

+ facet_grid(~variable)to teas them apart. Also give it a slightly nicer appearance using+ theme_light()What does the plot tell you? Has there been a particular drop in any year?

# plot long version of data frame

financial_long %>%

filter(variable %in% c("Close_dow", "Close_dax", "Close_nik")) %>%

ggplot(mapping = aes(x = Date, y = value)) +

geom_line() +

facet_grid(~variable) +

theme_light()

- Calculate the overall stock index price change per year. To do this, use

group_by()andsummarise()on the stock index change variables. Use the basicsum()-function insidesummarise()to compute the overall change in the year. In doing this, don’t forget there wereNA’s in two of the stock index price variables. Check out the result! When was the biggest drop in stock index prices?

# calculate aggregate change per year

aggregate_change <- financial %>%

group_by(year) %>%

summarize(

mean_dow_change = sum(Close_dow_change),

mean_dax_change = sum(Close_dax_change, na.rm = TRUE),

mean_nik_change = sum(Close_nik_change, na.rm = TRUE)

)

aggregate_change# A tibble: 20 x 4

year mean_dow_change mean_dax_change mean_nik_change

<dbl> <dbl> <dbl> <dbl>

1 1999 NA 1529. 5903.

2 2000 -709. -455. -5561.

3 2001 -766. -1254. -4436.

4 2002 -1680. -2112. -2235.

5 2003 2112. 718. 327.

6 2004 329. 180. 1335.

7 2005 -65.5 1108. 3219.

8 2006 1746. 1189. 1504.

9 2007 903. 1470. -1918.

10 2008 -4697. -3257. -6448.

11 2009 1880. 1147. 1513.

12 2010 1021. 957. -318.

13 2011 648. -1016. -1774.

14 2012 721. 1714. 1940.

15 2013 3566. 1940. 5896.

16 2014 1479. 253. 1159.

17 2015 -379. 937. 1583.

18 2016 2159. 738. 80.7

19 2017 4957. 1266. 3439.

20 2018 -455. -960. -2395. - The results up to now suggest that modern financial markets are closely intertwined, to the extent that a change in one market can bring about a change in the markets. Evaluate this aspect of financial markets by calculating all correlations between the three stock index change variables using the

cor()-function.cor()can take a data frame as an argument to produce the full correlation matrix among all variables in the data frame. This requires, however, that the data is stored in a “wide” format. Reactivate the old, widefinancialdata set and use it insidecor(). Before that select the variables you are interest in. Again, don’t forget about theNAs - there is an argument forcor()to deal with them. How closely are the stock indices related and which ones are most closely related?

financial %>%

select(Close_dow_change, Close_dax_change, Close_nik_change) %>%

cor(., use = 'complete.obs') Close_dow_change Close_dax_change Close_nik_change

Close_dow_change 1.000 0.570 0.169

Close_dax_change 0.570 1.000 0.318

Close_nik_change 0.169 0.318 1.000- Evaluate the stability of the relationships between financial markets by calculating pair-wise correlations for each year using

group_byandsummarise(). Note that here you have to specify each pairwise correlation separately insidesummarise().

financial %>%

group_by(year) %>%

summarize(

cor_dow_dax = cor(Close_dow_change, Close_dax_change, use = 'complete.obs'),

cor_dow_nik = cor(Close_dow_change, Close_nik_change, use = 'complete.obs'),

cor_dax_nik = cor(Close_dax_change, Close_nik_change, use = 'complete.obs')

)# A tibble: 20 x 4

year cor_dow_dax cor_dow_nik cor_dax_nik

<dbl> <dbl> <dbl> <dbl>

1 1999 0.453 0.0730 0.192

2 2000 0.308 -0.0519 0.195

3 2001 0.667 0.255 0.287

4 2002 0.654 0.196 0.236

5 2003 0.695 0.127 0.249

6 2004 0.468 0.166 0.344

7 2005 0.390 0.0625 0.327

8 2006 0.594 0.100 0.266

9 2007 0.537 0.0874 0.394

10 2008 0.613 0.212 0.527

11 2009 0.732 0.175 0.260

12 2010 0.695 0.255 0.329

13 2011 0.796 0.185 0.351

14 2012 0.725 0.212 0.325

15 2013 0.566 0.161 0.256

16 2014 0.567 0.149 0.176

17 2015 0.538 0.254 0.295

18 2016 0.605 0.214 0.387

19 2017 0.554 0.367 0.395

20 2018 0.378 0.108 0.481- Another important aspect of financial markets are exchange rates between currencies. Generally, it is assumed that a strong economy translates into both a strong stock index and a strong currency relative to other currencies. For the end of this practical, let’s find out if that holds true our data. First, evaluate whether changes in exchange rates changes correlate with each other in the same way that stock indices did using the

cor-function.

financial %>%

select(Rate_eur_change, Rate_yen_change) %>%

cor(., use = 'complete.obs') Rate_eur_change Rate_yen_change

Rate_eur_change 1.000 0.391

Rate_yen_change 0.391 1.000- Now, evaluate whether exchange rates vary as a function of the difference between stock indices. That is, for instance, does a large difference between Dow Jones and DAX translate into a strong Dollar relative to the EURO? According to the above intuition this should be the case. However, there is an alternative economic hypothesis. That is, foreign investors who benefit from a rise in stock index price may be motivated to sell their holdings and exchange them for their own currency to maintain a neutral position. This would, in effect, depreciate the currency at the same time as the stock index is outperforming, thus producing a negative relationship. What do you think? Ask the data.

financial %>%

summarize(

cor_dow_dax = cor(Close_dow - Close_dax, Rate_eur, use = 'complete.obs'),

cor_dow_nik = cor(Close_dow - Close_nik, Rate_yen, use = 'complete.obs')

)# A tibble: 1 x 2

cor_dow_dax cor_dow_nik

<dbl> <dbl>

1 0.0869 0.569- Finally, evaluate the stability of the above relationship for each year separately. Can you make out a stable pattern? No? I guess it depends. As always.

financial %>%

group_by(year) %>%

summarize(

cor_dow_dax = cor(Close_dow - Close_dax, Rate_eur, use = 'complete.obs'),

cor_dow_nik = cor(Close_dow - Close_nik, Rate_yen, use = 'complete.obs')

)# A tibble: 20 x 3

year cor_dow_dax cor_dow_nik

<dbl> <dbl> <dbl>

1 1999 -0.639 -0.501

2 2000 -0.222 -0.479

3 2001 -0.393 -0.221

4 2002 0.162 -0.287

5 2003 0.772 -0.320

6 2004 0.253 0.427

7 2005 0.831 0.862

8 2006 0.776 0.0745

9 2007 -0.136 0.824

10 2008 0.825 0.788

11 2009 0.837 0.740

12 2010 0.714 0.932

13 2011 -0.334 0.459

14 2012 -0.248 0.727

15 2013 -0.235 0.898

16 2014 -0.856 0.781

17 2015 0.601 0.819

18 2016 -0.108 0.831

19 2017 0.784 0.629

20 2018 0.470 0.792 Datasets

| File | Rows | Columns | Description |

|---|---|---|---|

| ^DJI.csv | 8364 | 7 | Dow Jones Industrial stock history |

| ^GDAXI.csv | 7811 | 7 | DAX stock history |

| ^N225.csv | 13722 | 7 | Nikkei stock history |

| euro-dollar.txt | 6545 | 3 | Euro to dollar exchange rates |

| yen-dollar.txt | 8754 | 3 | Yen to dollar exchange rates |

Variable descriptions

| Variable | Description |

|---|---|

| Date | Current day |

| Open | Day’s price when the stock exchange opened |

| High | Day’s highest price |

| Low | Day’s lowest price |

| Close | Day’s closing price |

| Adj Close | Adjusted closing price that has been amended to include any distributions and corporate actions that occurred at any time prior to the next day’s open |

Variables of data sets “euro-dollar.txt”, “yen-dollar.txt”

| Variable | Description |

|---|---|

| Date (currently unnamed) | Current day |

| Rate (currently unnamed) | Day’s exchange rate in terms of 1 US Dollar. E.g., a value of .75 means that the respective currency is worth a fraction of .75 of 1 US Dollar |

Functions

Packages

| Package | Installation |

|---|---|

tidyverse |

install.packages("tidyverse") |

haven |

install.packages("haven") |

lubridate |

install.packages("lubridate") |